When I returned from my first backpacking trip in South America, I was flat broke. When I went through my bank statements from the 6 months I had spent traveling, I saw that I had racked up over £300 in banking fees simply for withdrawing cash and using my card!!! At the time, that £300 would have come in very handy but instead it was inflating the profit margins at HSBC. I learned a very valuable lesson that day…

If you are traveling the world on a budget, the last thing you need is hefty ATM and conversion fees from your local bank. This is where clever travel banking comes into play. By properly organising your online travel banking you can save money, cut your spending AND also make sure you don’t get a nasty surprise like a blocked debit card!

In this post, we are going to take a look at travel banking issues such as foreign card fees and propose some awesome hacks and solutions. We’ll also touch on exchange rates, money security and share a few secret insights.

Let’s get banking!

Righty ahoy, let’s get cracking take a look at the essential travel banking hacks that every broke backpacker should know.

Changing Cash

Personally, I always bring some hard cash with me when I am off on a long trip. It’s not ideal, it does pose a risk of theft and it isn’t something I can really recommend to you.

That said, for whatever reason you may one day need to bring cash and then change your home currency into local currency once you arrive. Money Changers inside airports usually offers the worst rates in town. They are basically playing on your naivety and your desperation to get your cab fare sorted ASAP. Only ever change a small amount of cash in the airport as you will nearly always find a much better deal once you hit town.

When looking to change cash, always shop around and always familiarise yourself with the up to date exchange rate. We use the Currency XE app which provides up to date rates in real time.

Once you find a money changer, do not be afraid to haggle for a better rate – you can usually bag a better rate if you are changing a large amount. Haggling for a better rate doesn’t really work at places like Western Union, but works really well at the boutique changers common in India, Bali, Nepal and Southeast Asia.

How To Avoid ATM fees

There is nothing more frustrating when it comes to travel banking than being charged unnecessary ATM bank fees every time you make a transaction from a foreign ATM. These transaction fees are usually substantial and can easily be the cost of your transport or the price of a beer.

For example, my bank charges me a fixed fee of £2.75 ($4) every time I use an overseas ATM. This is often in ADDITION to any local ATM fees which can be another $4. That means that if you withdraw $10, you can wrack up another $8 in fees. Madness right?

So what to do?

ATM Shopping To Avoid Local Fees

First up, try to find ATM’s that don’t charge a local fee. Usually, you can find one even if it means doing a bit of “ATM shopping” and making withdrawal enquiries from multiple different machines. The best way to do this is to find a banking plaza or shopping mall where local banks ATM’s are usually lined up next to each other or near to one another. When you find one, make a note of the bank’s name and seek them out in future.

Do remember that even if the local bank is not charging you a fee to use the machine, your home bank almost certainly is.

The next one may seem a little counterintuitive, but I suggest withdrawing large amounts of cash at once rather than extracting money each day. This is because ATM fee’s are usually fixed amounts, rather than percentage based commissions. Paying $8 in fees on $10 is outright obscene whereas paying the same $8 on $100 is far more palatable.

I know that in certain countries it can leave you feeling a little wary if you are carrying large wads of cash on you, so investing in a money belt with a hidden security pocket is a good move.

Stash your cash safely with this money belt. It will keep your valuables safely concealed, no matter where you go.

It looks exactly like a normal belt except for a SECRET interior pocket perfectly designed to hide a wad of cash, a passport photocopy or anything else you may wish to hide. Never get caught with your pants down again! (Unless you want to…)

Hide Yo’ Money!Avoiding Your Own Bank’s Fees

Once you’ve found a nice friendly local ATM that is not charing you to use it, there is still likely to be the problem of your bank charging you to use your card abroad.

As a rule, your bank will always charge you for using your card outside of your home country. This applies to both ATM withdrawals and card payments and exceptions are few and far between.

The answer is to simply not use your bank card when travelling. Happily there are a few workarounds you can employ to facilitate this;

- Some Credit Cards offer good deals on international use and will often waive card payment fees. It is however, less common for credit cards to waive international cash withdrawal fees. If you do use your Credit Card overseas, remember to pay your balance immediately or within a month otherwise you start accruing interest (that’s the trap they are setting for you).

- Get a dedicated travel banking card. This leads very nicely to our next section.

Get a Travel Bank Card

Travel bank cards fundamentally work in the same way as your regular bank card. The difference is that you pre-load it with an amount (usually via a Smartphone/iOS app) and then use it when you go traveling. Let’s look at the benefits;

- Travel bank cards allow you to manage your expenditure and not over-spend on your bank account.

2. They also offer some protection against theft – if a thief steals or clone’s the card, then they can get the amount pre-loaded onto the card but can’t clean your entire bank account out.

3. Best of all though, any travel banking card worth its salt will offer some kind of deal on ATM withdrawal fees and oversea’s card payments. For example, on my travel bank card I can withdraw £200 per month FEE FREE. I can also make fee free unlimited card payments.

A word on currencies – when you load a travel card you load it with a chosen currency (USD, GBP, EUR etc). When you use it on the ground at your destination, a currency conversion will be applied using you card issuers rates. Therefore you will generally see some slight discrepancies here and there. These will sometimes work in your favour and sometimes against you.

Want to know more? Check out our in-depth explanation of how travel foreign exchange works here.

Which Travel Bank Card Is The Best?

The travel banking card market is now in full bloom and there are quite a few different ones vying for your attention. Knowing where to start can be seriously bloody overwhelming and you may well be struggling to decide which travel bank card is the best.

Well, the answer is that it doesn’t really matter which is the best because you can have as many as you like! Furthermore, we suggest that you take full advantage and obtain multiple cards. Still, we do have a few personal recommendations for you so get ready to meet the future of your personal travel banking.

| Which Card? | Free ATM Withdrawal Limit | ATM Withdrawal Fee’s | Overseas Card Payment Fee’s |

|---|---|---|---|

| Revolut | $275 | 2% | $0 |

| Monzo | $275 | 3% | $0 |

| Transferwise | $200 – $550* | $0.75 (up to the next $200) | $0 |

| Payoneer | $0 | $2.75 | $0 |

Wise

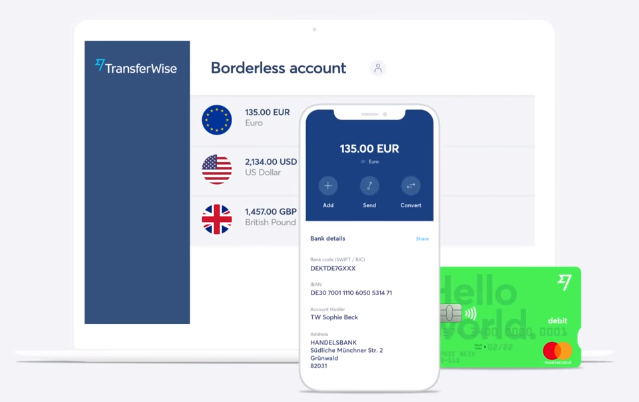

Wise (formerly Transferwise) initially existed as online antidote to Western Union and the primary model was facilitating low fee, money transfers between countries.

However, the Transferwise star is in the ascent and Transferwise have now launched a Debit card which connects to your Transferwise account. You can use the card to withdraw cash, or pay for dinner just like with any other bank card.

For travellers, the Transferwise benefits vary quite a bit depending on where in the world your card was issued (ie, your home country). Typically though, you are entitled to 2 separate foreign withdrawals a month of between £100 – £200. As a UK resident, I can withdraw 2 x lots of £200 meaning it’s as goos as Monzo & Revolut.

Revolut

A real market leader is Revolut, an online bank which operates via your smartphone.

For travellers, Revolut offer free ATM withdrawals of up to £200 ($275) per month. After the initial £200 limit has been reached, they charge a 2% withdrawal fee which can still work out cheaper than a standard bank withdrawal fee. However, if you add a few other travel cards to your collection, then you probably won’t need to go over the zero-fee limit at all.

You manage your Revolut account via your phone from where you can make instant transfers and top-ups, change your pin, and even make bank payments.

Payoneer

Payoneer is much like Transferwise. It started out a low fee international money transfer facility which is gradually morphing into a proper bank.

Their debit card is not quite as appealing as the Transferwise one as ATM withdrawals are charged at $2.75. However, they do offer fee free card payments.

Top Tip: The greatest hack is to obtain multiple travel cards in order to make the most of the fee-free withdrawal amounts. Personally, I have both Monzo and Revolut so I can withdraw £400 per month without paying fees which does me.

Pro Tip: If you are traveling as a couple, then open 1 account each, and then open a 3rd, joint account for an extra ATM free fee limit.

Monzo

Monzo is another fin-tech start up which may one day rival the worlds big banks.

When Monzo launched, they tempted travellers (like me) by offering unlimited ATM withdrawals with zero fees. They have now substantially reduced this to £200 ($275) per month. That said, used in conjunction with Revolut, that’s £400 ($550) per month you can withdraw from foreign ATM’s without paying a single penny-cent in fees.

Monzo also offer unlimited, free card transactions outside of your home country.

Much like Revolut, Monzo is managed by an app and offers many of the same functions as Revolut. You can also open a joint Monzo account with another person and you can use Monzo to pay Direct Debits and Standard Orders meaning its good for both travel and domestic use.

We’ve tested countless backpacks over the years, but there’s one that has always been the best and remains the best buy for adventurers: the broke backpacker-approved Osprey Aether and Ariel series.

Want more deetz on why these packs are so damn perfect? Then read our comprehensive review for the inside scoop!

View on Osprey View on REIFinally, it recently came to our attention that citizens of the US can open a bank account with Charles Schwab who will refund 100% of overseas ATM fees. Very Noyce!!

Travel Banking & Money Tips

Now that we’ve dealt with the fundamentals, let’s take a look at some other important aspects of travel banking that will save and protect your money whilst travelling.

Getting Excellent Exchange Rates

For this step of travel banking, you need to familiarise yourself with the exchange rate of the country you are going to. There are a tonne of currency exchange apps you can download onto your phone but my favorite is XE Currency Pro which is completely free! There are also some great online tools available. Knowledge is power and knowing the rate stops you been unduly ripped off.

My next piece of advice is to avoid currency exchange booths. Usually, people flock to these at airports but this is the most likely place to get stung with high fees and poor rates. On the other hand, if you find a local money changer you can usually negotiate a bit especially if you are changing a large amount.

On the road, you will be bumping into fellow travelers constantly. If they happen to be traveling in the opposite direction to you, exchange your cash with them. I have used this trick quite a few times and swapped cash with plenty of travelers I’ve met on the road.

International Money Transfers

Personally, I often have to move money around when traveling. I’ve found Transferwise to be the fastest and cheapest way to internationally transfer money between bank accounts.

These days, I have a Thai bank account which I use for most of my day to day living expenses, since I’m currently based in South East Asia.

Transferwise, now also issue a lovely green Debit card which you can use to withdraw cash and pay for things. The new app also allows you to manage your balances and expenditure easily.

Tell Your Bank You’re Hitting The Road

We said earlier on that you should try not to use your bank card when travelling. Still, at some point you may have no choice. Therefore, before you set off you should call your bank and let them know what your plans are.

Why is this you say?

Because if your bank notices “unusual activity” on your card (making transactions abroad!) it may suspend your account to prevent fraudulent activity. However, when it’s you making those transactions, a suspended bank card is a major pain in the ass.

Prevent an unwelcome surprise by informing your bank of your travel plans before you go. They will often put a note on your account to ensure your card is not frozen when you use it in the country you are traveling to.

If you are heading overseas for a longer time there will be a whole host of different aspects you will need to consider, not only banking and access to funds alone. Check out Western Union’s post How to Become an Expat for some top tips on getting yourself set up in your new home!

You should also sign up for Online Banking before you leave. It can often be easier to contact your bank online rather than trying to phone them from the other side of the globe.

Always Have a Spare Bank Card

Losing your bank or debit card when traveling is a monumental pain in the arse. Getting a replacement sent out to you can either prove difficult and slow, if not totally impossible. Therefore do not ever leave home without at least 2 cards in hand. This can be 2 different bank accounts, a bank account plus a credit or multiple pre-paid travel card.

But whatever you do, do something.

Also remember make sure NOT to ever leave them all tucked in your wallet – if you lose it, you lose them all! Take one out with you and leave the others safely stored with your bags and passport.

Stop Any Unneeded Direct Debits

So you’re all set to go backpacking around Southeast Asia. See you in 6 months home! You’ve packed your bag, sorted your Visa and even got a Yellow Fever jab. But have you remembered to review your direct debits? If you’re going to be in Thailand for the foreseeable, then do you really need to be paying $20 per month for PureGym in Brighton?! How about that US Sim card which isn’t going to work overseas?

I always review my Direct Debits before beginning a trip to see if there is anything I can cancel and usually save myself a few bucks per month. Obviously, check the Direct Debit cancelation terms before you do this to avoid late payment fees.

Hide Your Cash

Whether you are carrying $50 in your wallet, or $5000 in your backpack, you absolutely need to take care to hide your money when traveling. Sadly, travellers are often a target for street thieves and even hostel dorms are not as safe as we would like to think.

Protect whatever cash you have by hiding it. For tips and tricks, check out this post on the best ways to hide your money when traveling.

I strongly recommend keeping your cards in an RFID blocking wallet.

Final Thoughts on Travel Banking

That’s pretty much it! I’m hoping you got at least one money or hassle-saving tip from this article.

Travel banking, although often overlooked, is very important when you’re trying to save money on the road — heck, it’s one of the top things I wish I knew before I started travelling! But learning and improving is part of what the beautiful roads of life have to offer us.

Do you have any suggestions that we might have missed? If so, let us know down in the comments.

Happy banking, amigos!

And for transparency’s sake, please know that some of the links in our content are affiliate links. That means that if you book your accommodation, buy your gear, or sort your insurance through our link, we earn a small commission (at no extra cost to you). That said, we only link to the gear we trust and never recommend services we don’t believe are up to scratch. Again, thank you!