This old world is big, it is beautiful, and it has a lot to show us. Deciding to travel was undoubtedly one of the most enriching decisions I’ve ever made, and every day on this blog I get to help thousands of you guys do the same. Yet, in the whirlwind of anticipation, it’s easy to overlook mundane (yet crucial) details like ensuring our passport is current or securing travel insurance…

Skipping travel insurance, unfortunately, can be a regrettable oversight. No traveller is ever exempt from unexpected mishaps, and unforeseen incidents can occur. From my own experiences, I’ve had to rely on my insurance more than once, and now, I never embark on a journey without it.

If you’re reading this, you likely understand the importance of international travel insurance. I am going to offer up my considerable experience and expertise. Let’s take a closer look at what international travel insurance is, why you may need it, and where to buy it.

Photo: @Lauramcblonde

What Is The Best International Travel Insurance?

World Nomads

- > Offer coverage for more than 150 activities

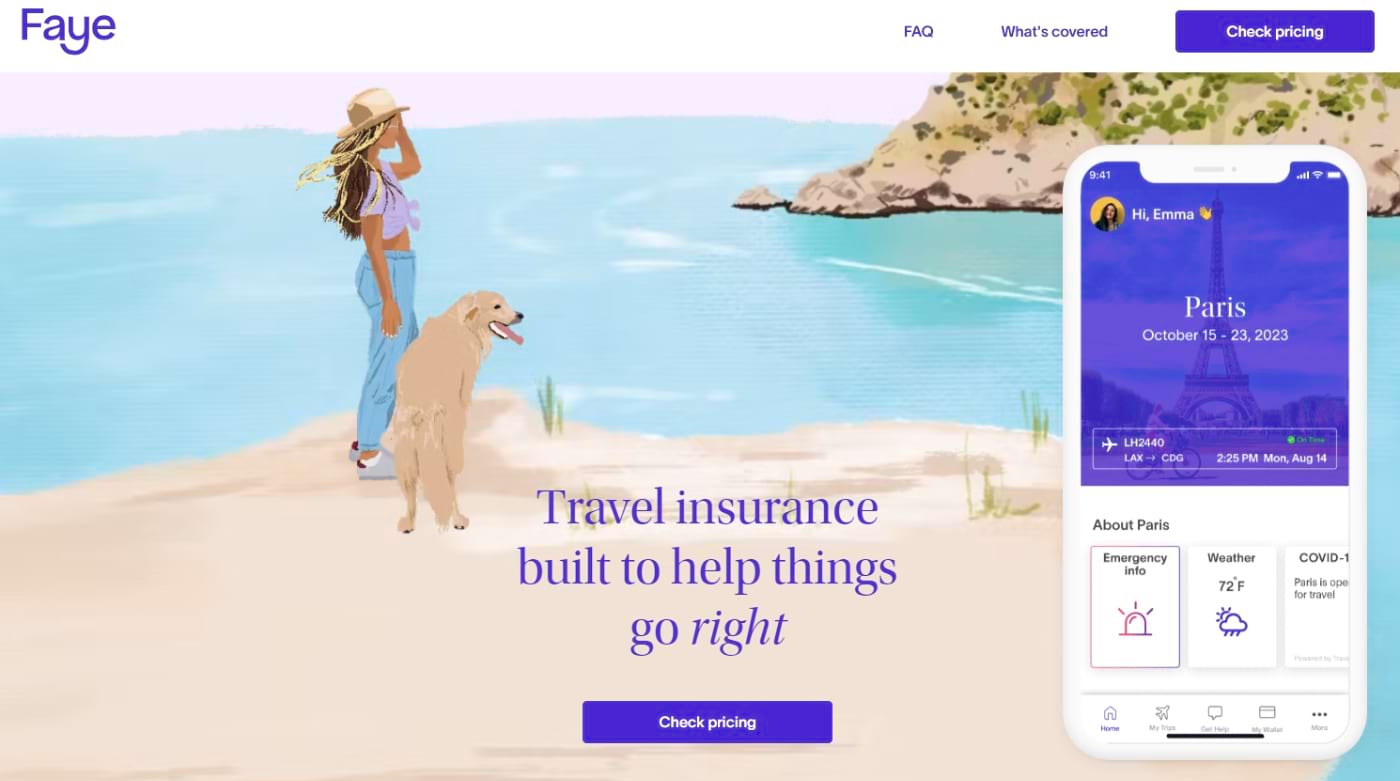

Faye

- > Innovative app based travel insurance

SafetyWing

- > Flexible medical insurance

HeyMondo

- > Offering a 24-hour assistance

Visitors Coverage

- > Customizable plans

Iati Seguros

- > Provide competitive cover amounts

Columbus Direct

- > Travel insurance for Ozzies and Kiwis

Insure My Equipment

- > Travel insurance for expensive equipment

Insurance For International Travel: A Breakdown

Travel Insurance is insurance designed to cover the various risks associated with travelling, domestically and internationally. Its primary purpose is to provide protection against unforeseen circumstances and events. You know, those common “oh, shit” moments that might arise before or during a trip.

Travel insurance can cover a range of eventualities, and the specific coverage depends on the policy you choose. However, typically travel insurance can cover the costs associated with things like missed flights, lost baggage, and getting sick and needing medical treatment when on vacation.

Now, you might well be wondering how travel insurance differs from health insurance. Don’t worry, we will explore the differences as we progress through this post.

However, for our US readers, it is absolutely vital to understand that your domestic health insurance will quite probably NOT cover you internationally. Therefore they should look into solid travel insurance for international travel.

This is where travel insurance steps in. Furthermore, international travel insurance can also cover not only health concerns but also other travel-related issues.

Unlock Our GREATEST Travel Secrets!

Sign up for our newsletter and get the best travel tips delivered right to your inbox.

What Does International Travel Insurance Cover?

Firstly, we must make it very clear that all travel insurance policies are different and all have their own inclusions, exclusions, quirks and terms and conditions.

However, most international travel insurance policies typically offer some coverage for the following;

Lost Luggage

Imagine reaching your destination, only to find your perfect travel backpack hasn’t. With a 1 in 150 chance of this happening, having lost luggage coverage can save you from the financial burden of replacing everything.

However, it is also worth bearing in mind that some international travel insurance policies take ages to process claims and your vacation may well have been and gone by the time they pay out. Thankfully though there are now a number of fin-tech, app-based insurers who offer ultra-fast lost luggage claims and can transfer funds to e-wallets within a matter of hours. We will look at a few of these later.

Trip Interruption

You may have realised by now that life is unpredictable. Factors like sudden illnesses or emergency events can disrupt trips. Coverage ensures you’re not out of pocket due to unforeseen events.

Trip interruption insurance is a component of many travel insurance policies. It’s designed to protect travellers from certain unforeseen events that cause trips to be cut short after it has already begun.

Photo: @audyscala

If such events occur, trip interruption insurance can reimburse the traveler for prepaid, non-refundable portions of their trip. In some cases, they’ll include the cost of returning home earlier or later than originally planned. Examples of events that trip interruption may cover include natural disasters, the sudden outbreak of war, or being summoned home for jury duty!

Trip Cancellation

Trip cancellation cover can help to recover the lost cost of having to cancel a trip. This can include things like the cost of flights, non-refundable accommodation costs, and any pre-booked tours or excursions. If you are going on an expensive all-inclusive package type trip (like a cruise) then check that you get a good, strong trip cancellation cover.

Oh, and by the way, trip cancellation is far more common than you’d think: 1 in 20 travellers have had to cancel their plans. This coverage therefore safeguards your investment.

We’ve tested countless backpacks over the years, but there’s one that has always been the best and remains the best buy for adventurers: the broke backpacker-approved Osprey Aether and Ariel series.

Want more deetz on why these packs are so damn perfect? Then read our comprehensive review for the inside scoop!

View on Osprey View on REITheft

The sad fact is that crime and theft are a universal reality. Despite that old dude with the stone tablet imploring that “thou shalt not steal”, the fact is that petty theft and serious robbery are both more common than we would like them to be. This is especially true in certain popular travel destinations where tourists are often the focus of organised criminals.

Being a victim of theft while traveling can be devastating, both emotionally and financially. International travel insurance assists in these trying times.

Medical Emergency

Did you know that you are disproportionately more likely to hurt yourself on vacation than you are at home?! Yep, tourists and travellers are apparently magnets for little mishaps. My personal highlights include cutting my foot on discarded beach glass, being savaged by a feral cat, and being badly assaulted by a murderous, stick-wielding gang while backpacking India.

Experiencing a medical emergency abroad is daunting. It can become downright depressing if the essential treatment you need racks up expensive bills. If you get seriously hurt in an expensive country, then medical bills can soar to thousands of dollars. Medical emergency cover therefore becomes a literal lifesaver…

Note that some countries do offer public healthcare (Go Europa!) and travellers may well be offered free-at-the-point-of-use healthcare if they need it. However, in many cases, the public health systems will seek to recover the costs from any non-citizen using their services.

Medical Evacuation

A medical evacuation is when a traveller is so badly injured or so terribly sick that they basically need to be sent home in a stretcher or on a drip. You guessed it… that is VERY, VERY expensive.

So yeah, in some extreme cases, you might need medical transport – a service that can cost upwards of $100,000. So maybe make sure that you have good international travel insurance that covers medical evacuation.

Photo: @amandaadraper

Repatriation (Alive and Dead)

The good news is that best estimates suggest that less than 1000 Americans die each year while on a foreign vacation. The bad news is that the 1000 or so who do shirk off this mortal coil when on strange soil, will find the cost of getting home to be considerable.

Sadly, airlines don’t allow “Weekend at Bernies” style antics whereby your friends pretend you are alive and walk you through airport security into your plane seat. Instead, they insist that dead passengers are embalmed, put into wooden boxes, and stashed in the hold along with luggage and dogs.

You’re then charged a whopping great premium for the disservice. Repatriation is expensive and you don’t want to saddle your family with the cost of bringing your back.

Other Stuff

We could go on but in the interests of our waning attention spans, let’s wrap this up.

Other stuff includes things like trip delays, access to foreign legal aid, and even the costs of paying off kidnappers… It’s a vast world out there, and good international travel insurance will hopefully ensure you are ready for it.

Our GREATEST Travel Secrets…

Pop your email here & get the original Broke Backpacker Bible for FREE.

How Much Does International Travel Insurance Cost?

Our US-based readers are (most probably) already paying out each month for medical and health insurance and so may well be understandably concerned about how much travel insurance is going to cost them.

Well, the answer is that it is impossible to say. The price of a travel insurance policy varies depending on where you are going, how long for, your own health, age, and a myriad of other factors.

However, to offer up some examples, World Nomads offers plans starting at $2.00 per day. As for an average cost? Well that’s hard to pin down, but either way travel insurance is always worth the peace of mind.

International Travel Insurance Providers – Our Top Picks

Did you know that there are over 5,000 licensed insurance companies operating in the US alone?! While not all of these offer travel insurance, you get a feel for the size of the industry, right? The travel insurance industry was worth over $5.5 billion in 2022 and an ever-increasing number of start-ups are competing for their slice.

So yes, there is a vast sea of providers out there. Fortunately, though, we have swam in it – so you don’t have to. Here are some of the international travel insurers that we’ve tried, tested, and trusted.

My Global Shield

My Global Shield is a travel insurance product that focuses on the specific needs of long-duration, frequent, and special-purpose international travelers.

My Global Shield provides insurance coverage tailored for international travelers, students, immigrants, and others. They offer a range of comprehensive options including visa traveler medical insurance, visa health insurance, visitors insurance, international travel medical insurance, trip insurance, and study abroad insurance??.

Some specific coverage details include medical coverage for accidents or illnesses while outside one’s home country, travel coverage for travel delays, lost checked luggage, emergency response, natural disasters, and personal liability. The medical coverage extends to hospital room and board, intensive care unit costs up to the overall policy limit, and local ambulance services.

Their policy prices are very reasonable but in terms of downsides, they don’t seem to offer a multi-country “backpacker” cover at this time.

World Nomads

We’ll go ahead and save you some precious time and energy: World Nomads travel insurance has been designed by travelers for travelers. They offer coverage for more than 150 activities as well as emergency medical, lost luggage, trip cancellation and more.

World Nomads provides travel insurance in well over 100 countries and if you leave home without travel insurance or your policy runs out, you can easily buy or extend while on the road.

They are not the cheapest on this list, but they are our ‘go-to’ for good reason.

Faye

We mentioned app-based insurers who can process claims ultra-fast earlier. Well, Faye Travel Insurance provides whole-trip travel coverage and care that brings out the best in each journey with industry-leading technology that enables smarter and smoother assistance with faster claims resolutions. Their innovative app-based travel insurance covers your health, your trip and your gear all via an app that provides real-time proactive solutions, quick reimbursements and 24/7 customer support.

If you ever do need to make a claim, then you simply log in to the app and the claim will be assessed super quickly from anywhere in the world! Best of all, if and when the claim is successful then the funds will be immediately credited to the smart wallet on your phone or device and ready for you to spend on new gear.

SafetyWing

SafetyWing is a well-priced, easy-to-use, and overall good travel insurance that is meant to be used primarily for medical expenses. With affordable rates, a very convenient payment system, and some notable perks, SafetyWing is a solid choice for those who need flexible medical insurance while traveling.

It is intended for long-term travellers who don’t really need much in the way of trip interruption or cancellation cover which makes it ideal for digital nomads and slow travel budget backpackers. SafetyWing are NOT the best option for any traveler who wants comprehensive trip cancellation, interruption or theft cover.

SafetyWing uses a subscription-based payment system, wherein travellers pay for insurance on a monthly basis, as opposed to all at once in the beginning. This method of payment can be easier on a backpacker’s wallet, especially when you consider that rates can be as low as $42/month. If you are wondering what is the best international health insurance, then it may well be these guys.

HeyMondo

Heymondo are up-to-date when it comes to combining travel insurance with technology for a quick and easy experience. What truly sets them apart is their assistance app which offers a 24-hour medical chat, free emergency assistance calls, and incident management. How reassuring is that?!

They also have a complication-free way to make a claim straight from your phone. No deductibles are also an added bonus.

Medical expenses are covered up to $10,000,000 USD so try not to damage yourself with anything over that amount… If you’d like travel insurance that operates with that little extra swiftness and ease, give these guys a go.

Visitors Coverage

Customizable plans that cater to diverse travel needs.

Iati Seguros

Iati Seguros is a Spanish-based travel insurance company that we have personally used and loved. You will notice that they provide competitive cover amounts for the key travel insurance areas, and are competitively priced. So far we have heard nothing but good things about them.

They also offer multiple ones, but we have focused on the Standard Plan. We wholly encourage checking out all plans for yourself to identify the best one for your needs.

Columbus Direct

These guys offer some kickass deals on backpacker travel insurance for Ozzies and Kiwis. If you have a pre-existing medical condition, be sure to read the terms and conditions thoroughly before taking up the insurance.

Insure My Equipment

Insuremyequipment.com is a website providing comprehensive travel insurance for expensive equipment (like camera gear). You can get specific pieces of gear insured so you know exactly what will be covered. I have had a separate cover for my MacBook for years now and was very glad that I had it when the Motherboard blew back in 2018…

Ok, so an Insure My Equipment policy works well in combination with another cheap travel insurance that covers medical expenses. That way you can have the best of both worlds.

Final Thoughts on Travel Insurance International

There we have it. By now you should know whether you need international travel insurance for your next trip or not. You hopefully understand the risk of not having it, and the potential benefits of getting it sorted. The international travel insurers we introduced here are all decent companies who we know and trust but there are many more out there.

Like a trusty travel companion, good travel insurance has your back, rain or shine. It’s not just about the potential financial savings but also the peace of mind of knowing you’re covered. As the old adage goes, “It’s better to have it and not need it than need it and not have it.”

See you on the road and stay safe.