Planning and preparing for a trip can be fun and exciting. Personally I love flicking through Lonely Planets seeking out those “Must See” places and I even enjoy scouring through forums for insider advice. I relish the challenge of arranging sophisticated logistics and revel in finding bargain flights from London to the ends of the earth.

Indeed, the feeling I get during the days before I start a trip is both exciting and invigorating. In fact, sometimes I wonder whether I’m equally as addicted to this “state of leaving” as I am to travel itself – they do say that often anticipation is even better than the event itself.

What is far less exciting though, is comparing Travel Insurance policies. There are far too many policies and providers out there with far too many fine print details to scrutinise. Yep finding the best travel insurance is confusing, and finding cheap backpacker insurance can seem impossible. But, to make finding and buying Travel Insurance that bit easier for you, we have tried, tested and reviewed all of the major providers out there.

- Allianz Travel Insurance Review

- Do You Need Travel Insurance?

- What Does Travel Insurance Cover?

- Should I Get Insurance?

- Who Are Allianz?

- Allianz Travel Insurance Policies

- What’s Covered By Allianz Travel Insurance?

- What’s Not Covered by Allianz Travel Insurance?

- Who Is Allianz Travel Insurance Suitable For?

- Who isn’t Allianz Travel Insurance Suitable For?

- How Much Does Allianz Travel Insurance Cost?

- Other Travel Insurance Providers

- When Should You Buy Travel Insurance?

- How to Make an Allianz Travel Insurance Claim

- Final Thoughts on Allianz Travel Insurance

Allianz Travel Insurance Review

Today we are going to review Allianz Travel Insurance. I have spent hours going through their policies and breaking them down for you. By the end of this post, you should know whether Allianz is the right travel insurance for you.

It’s important that you take time to look at other good travel insurance providers too. Different providers suit different kinds of travellers. So you may be better suited elsewhere.

Before we begin the Allianz Travel Insurance review, do note that the terms and conditions of insurance policies are subject to changes and are always ultimately based on your individual circumstances. Therefore, it is very important that you read any policy terms and conditions yourself.

Hey you there! Before you delve any further or waste any more valuable time on this Allianz Travel Insurance Review, let me just tell you straight up front that we at The Broke Backpacker no longer use Allianz for our travel insurance needs.

We have nothing against them, we just found other providers more suited to the needs of travellers and backpackers whilst offering VERY competitive quotes.

If you are taking a single trip or going backpacking, we recommend World Nomads Insurance.

Alternatively, if you are a digital nomad working and travelling remotely from all over the world, then SafetyWing Insurance offer some very interesting travel insurance plans.

Visit World NomadsAhem – Please note that insurance companies change their policies and product terms fairly regularly. We do our best to keep this review up to date but cannot guarantee that all of the information is 100% correct. Therefore, only use this review as a guide and check all policies yourself. Also note that some of the links in this post are affiliate links.

Unlock Our GREATEST Travel Secrets!

Sign up for our newsletter and get the best travel tips delivered right to your inbox.

Do You Need Travel Insurance?

Do you need travel insurance? Does anybody really need travel insurance?

After shelling out for flights, visas, and a new backpack, having to find a few more bucks for travel insurance may feel a bit depressing. I mean, all you get is a “policy certificate” AKA a boring 100-page booklet to read. Aren’t there more sexy and fun things to be spending that money on?

After all, most trips, vacations, and odysseys end happily and safely without any ill occurrence. There is no definitive answer to this.

Our team at the Broke Backpacker, we have (collectively) spent more than a century backpacking the globe and we have visited over 100 countries. Most of those trips ended without incident. However, we have also clocked up a fair few mishaps along the way: inflected legs, tropical diseases, broken backs, and even gunpoint robberies.

These incidents were all bad enough in themselves, leaving physical and mental scars. Thankfully though, we were all insured at the time. This meant that we were spared the further trauma of paying out thousands in medical bills or replacing technologies.

Basically, insurance is one of those things that most people never actually need. But the ones who do are very lucky to have it.

What Does Travel Insurance Cover?

So now, you get the picture: travel insurance is essential when it comes to staying safe on the road. But is Allianz travel insurance right for you? Or do other travel insurance options suit you?

So let’s take a look. Here are some things good travel insurance plans help with, and where you would be without them.

Lost Luggage

Luggage gets lost both on planes and in airports. It shouldn’t happen, but it sure as hell does.

That in itself is bad enough but replacing all your essential travel gear will cost. Any decent travel insurance policy usually covers lost luggage, usually up to at least $1000.

In fact, the aviation watchdog states that 5.73 items of luggage are lost for every 1000 passengers. That means that if you take 10 flights, then there is a 5% chance of your luggage getting lost forever. Some airports and airlines lose more baggage than others but all of them are equally as obtuse and obstructive when it comes to trying to make a claim.

Lost luggage can ruin your whole trip. I mean, imagine you head to Iceland and they lose all your cold weather gear?!

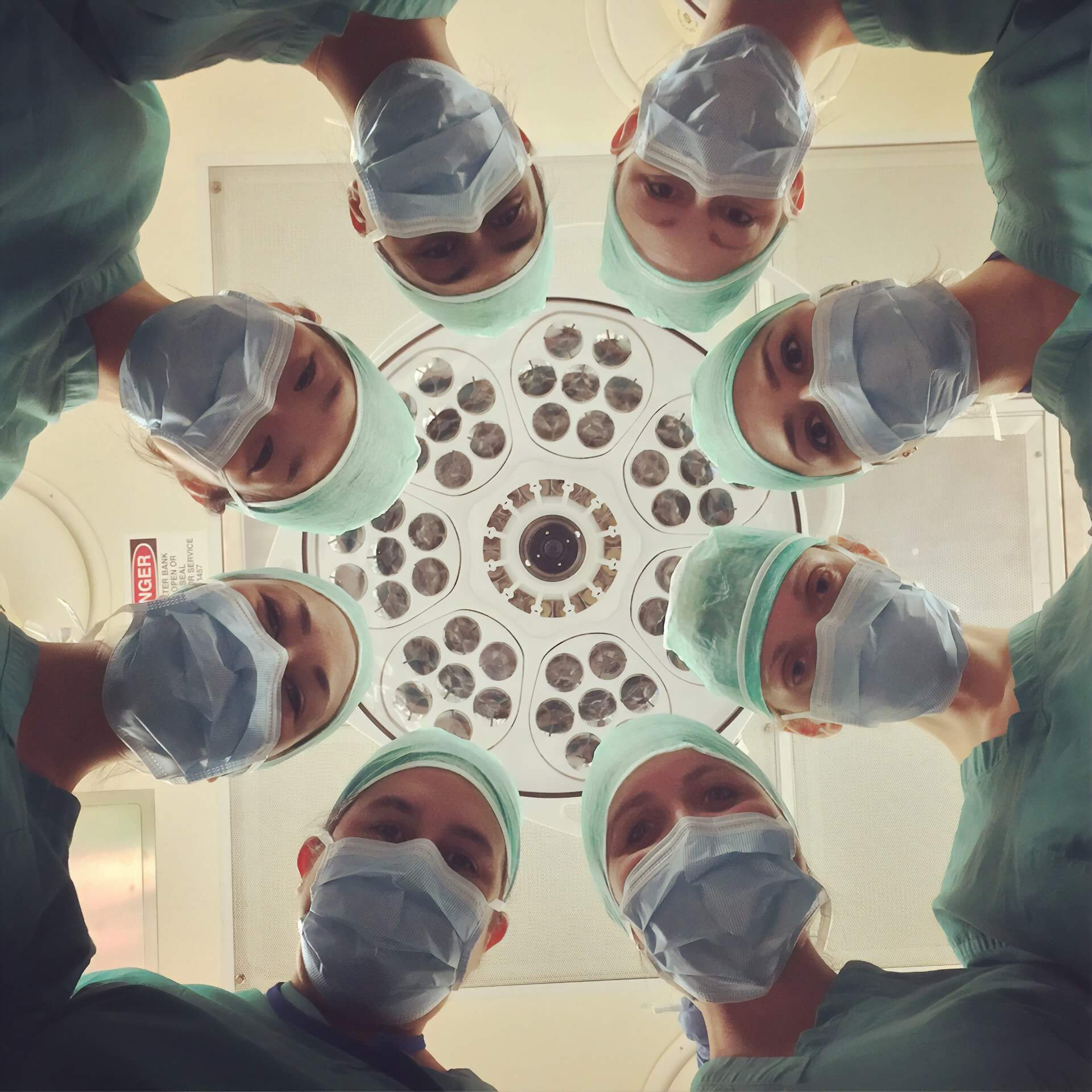

Medical Bills

Foreign medical care costs can be very high. A friend of mine was once hospitalised while backpacking in Costa Rica and ran up bills in excess of $10,000.

More recently he spent 1 night in a Thai hospital, was billed $1,000 and his passport was used as a ransom (that boy has no luck. Maybe he should stay at home?). Personally, I don’t have $10,000 to pay to Costa Rican Doctors, but I do have maybe $50 to buy myself a travel insurance policy.

If you come from Europe, the cost of medical care in some parts of the world is quite a revelation. If you’re in the US, then you already know all about health extortion. But do remember, your domestic health insurance will most probably not cover you outside of the US.

Accidents happen (and without warning…) and ill health can strike any of us down at any time, anywhere. In fact, if you have experienced the driving or the hygiene standards in India, you’ll already know that you are at high risk of coming to some harm out on the road.

Trip Interruption Coverage

Trip interruption comes in all shapes and sizes. Claiming for flight delays or cancellations is annoying – and in the end, nothing’s guaranteed.

Every year a few airlines or travel agents go out of business leaving passengers stranded. Booking flights home at short notice is costly.

Not getting home on time on the other hand, can mean getting sacked from your job – ouch. If you have to stay a few more nights at your destination waiting for a flight home, then that can also stretch a maxed-out travel budget.

Having trip cancellation and interruption coverage can mean the difference between desperately raiding your overdraft or getting a few extra days of vacation, free of charge.

Theft Coverage

Sadly, tourists are a target for thieves in many parts of the world. Our team have been robbed with guns while backpacking South America. And I know people whose diamond jewellery and MacBooks were burgled from hotels.

Being robbed is scary. But theft coverage makes it suck a little less when you don’t have to fork out for your stolen iPhone.

Repatriation

In the unlikely event of your demise, your travel insurance can cover the cost of repatriation or sending your body home. The costs of this can otherwise run into several thousands of dollars.

Should I Get Insurance?

Nobody ever thinks it will happen to them. And yet, it does happen.

Furthermore, the law of averages dictates that if you travel enough, something, somewhere will eventually go wrong. Just like you should always look twice before crossing the road, and always wear your helmet before riding a bike, you really should get comprehensive travel insurance.

By the way, some countries require you to obtain insurance before even letting you enter. Imagine being turned back at the airport for the sake of a few quid?! I personally never leave home without first obtaining travel insurance plans from either World Nomads or SafetyWing.

Who Are Allianz?

If you’re reading this, then I guess you decided that you do need travel insurance. Yay! Welcome to the world of sensible adults (AKA accepting your own mortality and the fact that you have no control whatsoever over the universe, despite whatever bullshit “The Secret” may have told you).

Allianz travel insurance is perhaps one of the biggest insurance companies in the world. They have been trading for over 120 years and they have offices across the globe.

Though travel Insurance is by no means Allianz’s primary focus or modus operandi. But this is not a bad thing. Note that even “specialist travel insurers” are often, in fact, brands or shop fronts backed by big insurance companies like Allianz.

They are governed by the Financial Services regulators in pretty much every national market they trade in. This means that if you have a problem with them, you can squeal on them and have your case reviewed independently and fairly by an adjudicator free of charge.

Now that the introductions are out of the way, let’s take a look at the individual travel insurance policies they offer.

Allianz Travel Insurance Policies

Allianz are a major financial service provider and as such, they offer different coverage options, policies and plans aimed at different travellers. Let’s quickly run through them.

Firstly, Allianz travel insurance offer travellers 2 main types of policy. Within these coverage types are little variations. The main policy types are OneTrip and AllTrips.

Within both the OneTrip and AllTrips umbrellas are 3 variations: Basic, Prime, Premier. These vary depending on how much cover you want and how much you want to pay.

As the name kind of suggests, OneTrip covers one single, specific trip generally with a fixed start and end date.

AllTrips covers any and all trips that you make in a one-year period. This annual plan runs from the date you take out the policy, or a date of your choosing, and lasts for 365 days (or 366 in a leap year).

You can take an unlimited number of trips in the year and an unlimited number of days travelling. Do be sure that all your chosen destinations are covered by the annual travel insurance policy though, otherwise, you may need to obtain additional cover.

OneTrip Basic Plan

This travel insurance policy covers all travel insurance basics such as medical coverage, trip cancellation and lost luggage. Look at it as the entry-level “classic cover” if you like.

The plan may be able to offer;

- Emergency Medical and Emergency Dental Coverage up to $10,000 and $50,000 for Medical Evacuation. These amounts may seem high but are not enough if you need to be airlifted home from an accident, for example.

- Lost or Stolen Baggage Coverage up to $500 and $200 for Delayed Baggage. Now, $500 may be enough for your baggage depending on how expensive your clothes are, and whether you pack any specialist equipment. However, a solid travel backpack is usually worth around $200.

- Trip Cancellation Cover up to $100,00. One of the best features of the OneTrip Basic plan is that Allianz may be able to reimburse the full cost of your trip if you need to cancel early. However, the reason for cancellation needs to be one of Allianz Global Assistance’s list of acceptable cancellation reasons – not because you got bored or changed your mind.

This policy is a good all-rounder and ideal for travellers on a budget. However, it does have some limitations.

Some of the Allianz travel insurance OneTrip basic coverage is a bit on the tight side. Furthermore, OneTrip Basic plan does not include coverage for missed connections or airline change fees. There are also relatively fewer accepted reasons for claiming on the trip cancellation clause.

OneTrip Prime Plan

Broadly speaking, Allianz OneTrip prime plan is more or less the same as the basic – with increased coverage amounts. The policy may be able to offer;

- Emergency Medical Coverage and Dental Coverage up to $25,000 worth of and $500,000 worth of emergency evacuation coverage.

- Lost and Stolen Baggage Cover up to $1,000 which should cover most people’s hold luggage. However, the per-item max is $500. So if you pack your $8000 top-quality travel camera, you will only get $500 back for it. It also includes Baggage Delay Costs of up to $300.

- Missed Connection Coverage up to $800.

- Airline Change Fees up to $250.

OneTrip Premier Plan

In case you need a bit more on top of that, then we have the OneTrip Premier Plan. The Allianz OneTrip Premier policy is essentially the Prime with even higher coverage amounts. OneTrip Premier may be able to offer cover to;

- Emergency Medical and Dental Coverage of up to $25,000 to $50,000.

- Emergency Evacuation Coverage also increases to $1,000,000. With international evacuation averaging around $100,000, this amount is more than adequate to cover your transportation back home.

- Lost or Stolen Baggage up $2,000. However, like with the OneTrip Prime plan, you can only claim a maximum of $500 per item (up to $2,000 in total). $600 in Baggage Delay.

- Travel Delay coverage up to $1,600.

- Missed Connection Coverage up to $1,600.

Other Allianz OneTrip Options & Offshoots

In case that wasn’t choice enough for you, Allianz also offers 2 offshoots of their OneTrip policy. If you like, look at them as the highly specialised cousins of the OneTrip family.

OneTrip Cancellation Plus Plan

OneTrip Cancellation Plus Plan is definitely Allianz’s budget policy. With this plan, you are only covered against trip cancellation, interruptions, and delays. Medical coverage, medical transportation, and baggage loss are not included.

Personally, I would only consider this policy if (1) you are not checking luggage (2) you have medical coverage elsewhere. For example, this may be OK if you are an EU citizen taking a short break to another EU country where you only have your trusty carry-on luggage and an EU emergency healthcare card.

OneTrip Emergency Medical Plan

This policy is great for travellers who only want medical coverage on one single trip. It provides up to £50,00 in emergency medical coverage and $250,000 in emergency medical transportation coverage.

Remember that this plan only offers protection for medical expenses. If you are robbed, your cuts and bruises are covered but your stolen phone is not. If the airline loses your luggage it is not covered and neither is heartbreak. Trip cancellation coverage is also not included.

This plan is, therefore, for anybody whose sole and only concern is medical coverage.

AllTrips

Remember, the OneTrip policies cover one specific trip. The AllTrips policies we are going to detail below cover long, or multiple trips within a one-year period.

Note that AllTrips policies may also be able to offer rental car coverage for damage as well as dismemberment cover. On the flip side, trip cancellation coverage is either non-existent or limited.

AllTrips Basic Plan

The AllTrips basic may be able to offer coverage for the “classic” issues on multiple trips within a one-year period. Let’s see those numbers.

- Emergency Medical Coverage of $20,000,00 and $100,000 in Emergency Evacuation Coverage. Note that $20,00 on medical emergencies may still be a little on the low side in the event you get very sick in an expensive part of the world such as the US.

- Lost/Stolen or Damaged Baggage up to $1,000. Yes, this may be able to cover most checked bags but remember the $500 max item clause. Baggage Delay is offered up to $200 and then $300 for trip delay.

- Rental Car Damage Coverage up to $45,000. Note that additional premiums may apply.

Note that the AllTrips Basic plan does not come with Trip Cancellation or Interruption Coverage. Remember that means you will not be reimbursed in case you are unable to go on your trip!

AllTrips Prime

As you probably guessed, AllTrips Prime is more or less the same as the basic package with some increased coverage amounts. The policy may be able to offer;

- Emergency Medical Coverage of $20,000,00 and $100,000 in Emergency Transportation Coverage.

- Trip Cancellation or Interruption Coverage up to $2,000.00. Remember that the reason for cancellation needs to be one of Allianz Global Assistance’s list of acceptable cancellation reasons.

- Lost/Stolen or Damaged Baggage up to $1,000 and $200 for Baggage Delay.

- Trip Delays up to $300.

- Rental Car Damage Coverage up to $45,000. Note that additional premiums may apply.

AllTrips Premier

If you want even more coverage, then we have AllTrips Premier. The Allianz AllTrips Premier policy is basically the Prime one with even higher coverage amounts. AllTrips Primer may be able to cover;

- Emergency Medical Coverage of $50,000,00 and $500,000 in Emergency Transportation Coverage.

- Trip Cancellation or Interruption Coverage up to $2,000.00.

- Lost/Stolen or Damaged Baggage up to $1,000 and $200 for Baggage Delay.

- Trip Delays Coverage of up to $1,500.00.

- Rental Car Damage Coverage up to $45,000. Note that additional premiums may apply.

- Dismemberment and travel accident up to $50,000 if you lose a limb or your eyesight when travelling.

Wanna know how to pack like a pro? Well for a start you need the right gear….

These are packing cubes for the globetrotters and compression sacks for the real adventurers – these babies are a traveller’s best kept secret. They organise yo’ packing and minimise volume too so you can pack MORE.

Or, y’know… you can stick to just chucking it all in your backpack…

Get Yours Here Read Our ReviewWhat’s Covered By Allianz Travel Insurance?

We’re now going to drill down and look at the various things that may be covered by Allianz travel insurance. Remember that some of these are covered by some policy types but not others, and note that coverage amounts and excess’ also vary depending on the exact Allianz policy type.

Emergency Medical Coverage

Got food poisoning in Delhi? Got hit by a moped in Bangkok? Or maybe you just slipped in the shower and broke your wrist in Madrid?

These things can, and do, happen and will all require emergency medical care. Being sick, infirm, and unable to make TikToks is bad enough as it is, so the last thing you want is a hefty medical bill which you have to pay out of your own pocket.

Emergency accident and sickness coverage is quite likely the most important aspect of travel insurance plans.

Emergency Transportation

Emergency Medical Evacuation is when you need to be sent to your home country, or another country, for further or continued medical treatment, and are too sick to travel home normally as a regular passenger. For example – if you are stuck in a hospital bed on a drip in a leg cast.

Trip Cancellation

Reimburses for prepaid, non-refundable cancellation charges if you must cancel your trip (after the effective date of your insurance plan) due to covered sickness, accidental injury, or death of you, a family member or travelling companion; inclement weather, unforeseen natural disaster at home or at your destination, strike, or other covered reasons.

Trip Interruption

Trip Interruption Coverage includes the same stipulations as listed above in “Trip Cancellation”. It includes the caveat of covering the cost of accommodation to you if you are delayed.

Baggage Coverage for Loss/Damage

Being compensated for baggage loss of lost personal gear is likely the second most important aspect of your insurance. This is one of the most common reasons file a claim on your travel insurance.

This covers reimbursement for loss, theft, or damage incurred during the trip. It can be applied to all personal items that were lost, stolen, or else accidentally blown off the roof of a chicken bus travelling at top speed.

Baggage Delay

In the event your checked baggage is delayed or misplaced by the air carrier (for more than 12 hours), you can claim reimbursement for any necessary items you need to purchase until your bag arrives. This will typically mean toiletries but may even mean some travel clothes if you can demonstrate the purchase is essential.

Trip Delay

Trip Delay cover protects you when you’re unable to reach your destination on time due to circumstances beyond your control. If your airline cancels your flight due to a technical fault, Allianz travel insurance will reimburse you for any meals, transportation, or accommodation costs you incurred as a result. Note that delays of less than 6 hours are not covered.

Change Fee Coverage

Have you ever tried to change or vary a flight date or add or remove a passenger?! The fees can be insanely high. This is where Change Fee coverage comes in. If you have the AllTrips Executive, OneTrip Prime plan or OneTrip Premier plan, you can claim up to $500 to cover the cost of the airline change fee.

Travel Accident Coverage

If you are in an accident, you may be entitled to claim a compensation payment in addition to your medical/repatriation costs. This is usually reserved for loss of limb/eyesight type scenarios and you can’t claim for whiplash or emotional trauma from falling from a donkey!

The Travel Accident Coverage is also payable to your family in the event of your death.

Rental Car Damage and Theft Coverage

The AllTrips travel insurance polices also include rental car coverage. This can often prove considerably cheaper than obtaining insurance direct from the rental car provider.

If you are resident in the US, this feature may not be available to you. For clarity, we suggest you speak with Allianz travel insurance directly.

What’s Not Covered by Allianz Travel Insurance?

There are some notable omissions from Allianz’s cover. Let’s take a look at them.

Pre-Existing Medical Conditions

If you have a pre-existing medical condition which causes you problems on your trip, it is not covered under the Allianz policies. This is fairly common amongst insurers. It is important that you do declare any pre-existing conditions when taking the policy out.

If you do have a pre-existing medical condition, then you may be very interested to hear that SafetyWing can offer full coverage for PEMCs in their policies.

Things go wrong on the road ALL THE TIME. Be prepared for what life throws at you.

Buy an AMK Travel Medical Kit before you head out on your next adventure – don’t be daft!

Buy on REIExtreme Sports

Allianz Travel Insurance does not any kind of adrenaline sport such as Quad Biking and Parachuting. The lack of coverage for extreme or adventure actives is one of the many reasons why we now prefer World Nomads. To get full details of the kind of activities World Nomads can offer coverage for, head over to their site and get a tailer made quote.

Who Is Allianz Travel Insurance Suitable For?

So as you can see, Allianz Global Assistance offers a lot of different policy types for a lot of different people. Allianz Travel Insurance maybe suitable for the following kinds of travellers;

- Annual Travellers – With the Allianz annual plan, you may be covered for a whole rotative journey around the sun, no matter how many times you travel! Annual plans are great for frequent and long-term travellers to save you money in the long run. On the other hand, though, SafetyWing offers a month-by-month policy which you can stop and start depending on how much you travel; this may prove to be more cost-effective.

- Senior/Ageing Travellers – Allianz travel insurance policyholders are among the best senior travel insurances. They have no age limit. Believe us, not all insurers offer this and we have a LOT of queries from over 65’s & over 70’s who have struggled to find insurance elsewhere.

- Travelling Families – Allianz travel insurance policies may allow children under the age of 17 to travel with their parents for free, on selected plans. This is great for families with kids. My earliest travel memory is of a Spanish ER department, my parents were glad they had me on their policy. Otherwise my foot would still be bleeding 33 years later!

Who isn’t Allianz Travel Insurance Suitable For?

Whilst they do offer a myriad of different plans to cover most travellers types, Allianz is perhaps not the ideal travel insurance company for absolutely everybody out there.

- Adventure Travellers – Allianz Travel Insurance does not offer protection for extreme activity or sport of any kind! If you plan on doing any dangerous, adrenaline-type activities, then perhaps consider World Nomads who can offer coverage for over 201 different extreme sports. SafetyWing are also rapidly extending their extreme coverage.

- Travellers Wanting High Medical Coverage – We usually recommend travelling with at least $100,000 of emergency medical coverage. If you come down with a severe illness or are mangled by a badger, you might be stuck with thousands of dollars in medical bills so need to be prepared. World Nomads do offer $100,000 in medical emergency cover.

- Corporation Haters – Allianz are a major international finance company and we know some of you prefer not to deal with such organisations. That’s a perfectly legitimate point of view. However, remember that even a lot of “boutique” insurers are in fact ultimately shop fronts for big insurers such as Zurich, Lloyds, or even Allianz. In fact, all some boutique firms do is sell you the illusion of dealing with a small firm and charge you a hefty commission for the privilege.

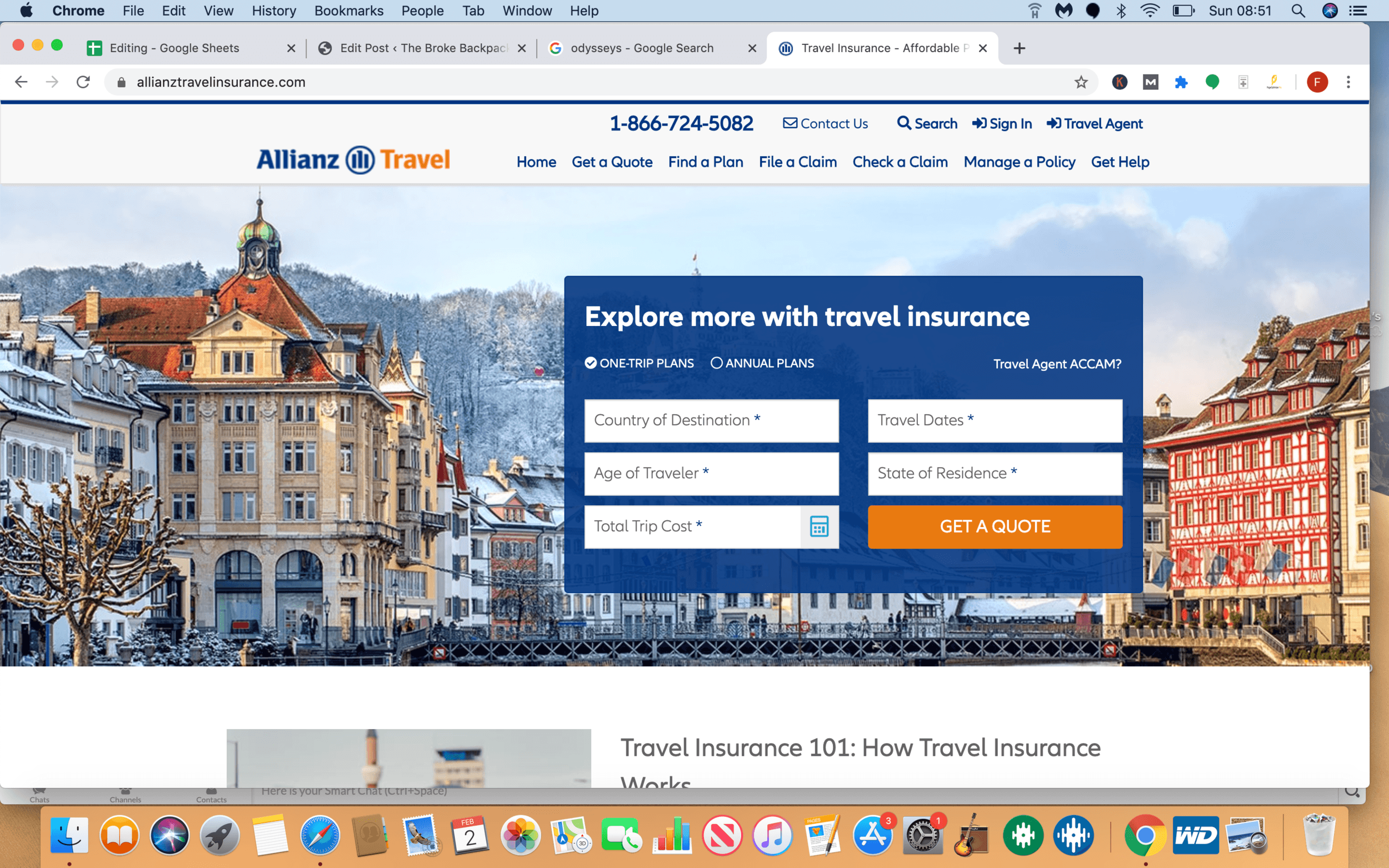

How Much Does Allianz Travel Insurance Cost?

So now we know the details, the next burning question is how much does Allianz Travel Insurance cost?

Well actually, it’s very difficult to say. The pricing details vary depending on a wide range of factors such as your age, location, your trip plans, if you have a pre-existing medical condition, and numerous other factors that only the gods of insurance can compute. It’s worth it to get in there and check yourself.

Other Travel Insurance Providers

So, now, let’s talk about our trusty travel insurance plans for backpackers.

World Nomads

World Nomads offers coverage for backpackers and adventure trailers. They are one of our favourite travel insurance providers and we have used them for years.

Unlike Allianz travel insurance, World Nomads are a travel insurer with a focus on backpackers.

World Nomads offer 2 separate plans depending on how much cover you want and what exactly you intend to do. World Nomads can also offer trip cancellation coverage, electronic gadget, and theft coverage in the policies.

Word Nomads can cover over 140 countries (but not Pakistan which is a shame for us). They can also cover a wide range of adventure stuff and extreme sports like mountaineering which Allianz travel insurance do not.

However, they do not offer home country cover and do not offer open-ended cover. If you are not planning on doing any adventure stuff though, then you may find World Nomads to be a bit expensive.

SafetyWing

SafetyWing are a relatively new player on the scene. They are founded by travellers, for travellers, and their primary target is for those travelling as a digital nomad: people like me who move around the world working from our laptops. We can go many years without ever going “home” and SafetyWing recognises this and can offer open-ended cover.

What we LOVE about SafetyWing is that their insurance operates like a monthly subscription that you can stop and start as and when you need it. They are also one of the few providers who may be able to cover some pre-existing conditions and provide assistance with “routine” health stuff.

We’ve tested countless backpacks over the years, but there’s one that has always been the best and remains the best buy for adventurers: the broke backpacker-approved Osprey Aether and Ariel series.

Want more deetz on why these packs are so damn perfect? Then read our comprehensive review for the inside scoop!

View on Osprey View on REIWhen Should You Buy Travel Insurance?

By this point, you may well know which travel insurance is best for you. Maybe it’s Allianz travel insurance, or maybe it’s one of the others.

The question now then is, when should you buy travel insurance?

You can buy travel insurance up until the start date of your trip for most insurers. Many will not cover a trip that has already begun – with the exception of World Nomads and SafetyWing.

Note: if you ever do make a claim, you may well be asked to provide evidence of the start date. So I do not recommend trying to hoodwink insurers. Be totally honest or it will come back on you.

However, in our experience, the earlier you book your travel insurance, the better. This is for a number of reasons:

- Things sometimes go wrong before the trip even starts. For example, if the airline goes bust. This happens to 1000s of people every year. Or what if you get very sick a week before flying and have to cancel?! If you have the right travel insurance in place, your insurer may cover you in these scenarios.

- The vast majority of policies include a cooling off period. This is a period of time (usually 28 days) when you can cancel the policy and get all of your money back. We suggest using the cooling period to read through the policy documents and ensure that the cover fully meets your needs. Upon a closer look, if it does not suit you, you have time to contact the insurer and amend the policy, or cancel it and obtain more suitable travel insurance.

Personally, I usually book my travel insurance the very same day I book my flight. The only exception is if I already have long term or an annual plan. In these scenarios, instead, be sure to check the last date on your annual/long-term cover and make sure it covers your whole trip.

How to Make an Allianz Travel Insurance Claim

First up, it is unlikely you will ever need to make a travel insurance claim. Yipee!

In case you do though, you will be very pleased to hear that the process is pretty straightforward as long as you are dealing with a reputable company. If you are not then it may be a lot harder.

To initiate a travel insurance claim, all you need to do is contact (call) Allianz Global Assistance and chat with their 24-hour multilingual staff. You should do this as soon as possible or as soon as you know you will need to make a claim .

You will need to tell them about your claim including details of what has gone wrong, and what the damage seems to be. You can also initiate the process online by signing into your account.

If you are claiming lost or stolen items, you will need to write up a formal sworn statement of events, detailing what happened and what was lost. You will also need to have an official police report made up – it is highly important that you obtain this even if it means paying a fee/bribe or hassling the police to do it. Try to get it in both the native language and in English if possible.

The Insurance company may contact you to discuss your claim further. You may even be subjected to a an anti-fraud interview and your call may even be run through voice detection software designed to spot deceit! However, you have nothing to worry about if your claim is legitimate and in order.

It is very helpful to get all of your receipts and invoices together first and submit all expenses at once. Do keep copies of every expense, bill, invoice, and report as you will need to provide these to the claims team. They may pay out small amounts without a bill, but in the case of extra hotels, flights, or electronics, the rule is usually “no proof = no payment”.

After that is sorted, you upload all of your information and documents, review the claim and submit. The Allianz team will get cracking and stay in contact with you throughout this process. Note that resolution time does vary from case to case. It may be days, weeks, or sometimes months depending on the details of your claim.

Final Thoughts on Allianz Travel Insurance

I hope you found this Allianz Travel Insurance Review to be informative – it certainly took a lot of work on our part to put it together! Comprehensive travel insurance is important to safe travel and you need to carefully choose the best provider for your needs.

We really care about the safety of our readers. That’s why we do recommend travel insurance so strongly. We’ve seen ourselves what can go wrong – and we wouldn’t wish it on anyone.

So check for trip interruption coverage, get your gadgets covered, but most importantly, make sure any potential medical expenses are covered, especially emergency medical expenses. Shop around different providers to find the right one for you. Once again, we wish you an awesome and safe trip!

And for transparency’s sake, please know that some of the links in our content are affiliate links. That means that if you book your accommodation, buy your gear, or sort your insurance through our link, we earn a small commission (at no extra cost to you). That said, we only link to the gear we trust and never recommend services we don’t believe are up to scratch. Again, thank you!

![Brutally HONEST Allianz Travel Insurance Review – [Updated 2023] Pinterest Image](https://www.thebrokebackpacker.com/wp-content/uploads/fly-images/716330/Allianz-travel-insurance-review-pin-260x337.jpg)